Fine Art & Valuable Articles Collections

Protect your special items with a valuables and collections policy.If you lose one diamond earring from an exquisite pair, it can be replaced with a gem of comparable quality. If your fine art is damaged, it can be restored. Or, if an item is lost, stolen or restoration or replacement is not possible due to its condition, you will be compensated for your loss.

What is Valuable & Collections Insurance?

Protection beyond standard valuables and collections insurance policies.Collecting vintage or antique items has never been more popular. With the proliferation of websites dedicated to collectors, finding valuable pieces to start or add to a collection can be done securely and privately from the comfort of your own home.

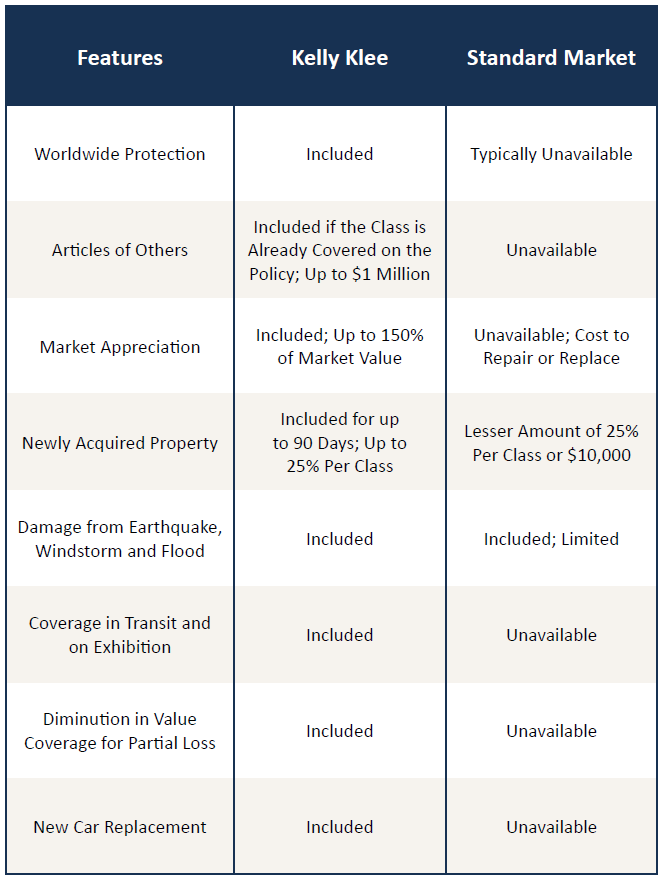

As a collection increases in value, verifying what type of coverage you have for valuables through your homeowner’s insurance policy is imperative. Most mass marketers of homeowner’s insurance place low limits on valuables or exclude coverage for many types of valuables.

If you have a valuable collection of jewelry, artwork, sculptures, wines, sports collectibles, fine china, or other items valued at over $2,000, you need to acquire separate valuable collection insurance.

How much coverage do you need?

High net worth families have more to lose.Store your documentation and photographs in a fireproof box or safety deposit box. As you add to your collection, keep the receipts and put them with your other documents. If you’ve had any prior appraisals, put those in your box, too.

Some collectibles are difficult to assign a value to but can be done by an experienced collectibles appraiser. To find an appraiser knowledgeable about rare or unique collectibles, inquire from other collectors at events, such as expositions or auctions where items similar to yours are being displayed or sold.

Never allow someone to appraise your collection and then make you an offer on any piece or pieces. Legitimate appraisers work independently and don’t engage in this type of conflict of interest.

A Special Class of Coverage

MARKET VALUE

Pays the market value of an insured item up to 150 percent of the scheduled amount, which allows for appreciation over time.

NEWLY ACQUIRED ITEM COVERAGE

Provides automatic dollar- or percent-levels of coverage (if you already have coverage on a collection) for any newly acquired similar items for up to 90 days, giving you time to add a new item to your coverage schedule.

PAIRS AND SETS

Reimburses you for an entire pair or set if one item is lost, damaged or stolen, and you surrender the matching item(s)—or you can opt to accept a comparable replacement, if available.

FRAGILE ITEM BREAKAGE

Covers losses due to breaks or fractures of delicate items.What Does Valuable & Collections Insurance Cover?

Coverage for your most precious possessions.Kelly Klee represents insurers specializing in assisting private clients, such as Chubb, AIG, PURE, and Cincinnati, and others who work closely with affluent clients. As a result, we can craft a coverage plan that will provide you with the valuable collection insurance you need and the peace of mind that goes with it.

Our clients have coverage that:

- Pays the market value of an insured item up to 150 percent of the scheduled amount

- Provides automatic dollar or percent-level coverage if you have existing coverage on a collection and acquire a new or similar item

- Reimburses you for a pair of items if only one of the items is lost, damaged, or stolen

- Covers breaks or fractures of delicate items

Check out the additional coverage available for valuables and collections:

How to get Started

A plan tailored

to your needs.

After taking time to understand your coverage needs, a personal risk manager will prepare a custom plan designed to protect what's important to you. We take a holistic approach to risk management that looks at your entire portfolio of risks to ensure you are properly covered. No detail is overlooked.