Luxury Vehicle Coverage

Protect your high-value vehicle with a high-value auto insurance policyJust as you need superior high-value home insurance coverage, so does your high-value vehicle. Mass market insurance is acceptable for mass-market products, but your luxury car, classic car, or antique car requires insurance coverage that was designed for high-value vehicles and which FRP Private Client customizes for you.

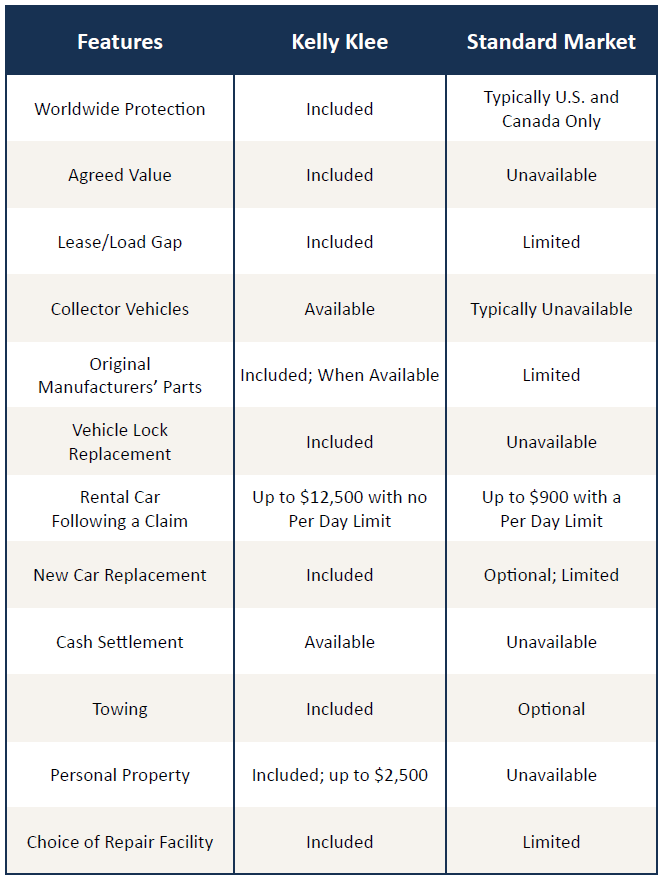

What makes high-value auto insurance be of greater value than the coverage the “good hands” or “good neighbor” type of insurers offer? There are more reasons to have high-value auto insurance than you can count on one hand.

What is High-Value Auto Insurance?

Protection beyond standard auto insurance policies.

How much coverage do you need?

Special care is required when evaluating coverage for high-value autos.You can pick and choose the options that work best for you. At FRP Private Client, we will listen to your needs and create a custom policy to meet them. So whether you need insurance for your luxury car, classic car, antique car or collector car, our high-value auto insurance can keep you covered.

At FRP Private Client, we offer our clients customized high-value vehicle insurance tailored to meet their needs. Along with your high limit liability coverage, every valuable option is presented to you. When our consultation ends, you’ll know that your coverage won’t disappoint you if the need to file a claim arises. Our high-value auto insurance will keep you covered.

A Special Class of Coverage

AGREED VALUE OPTION

Sets a value for your vehicle that you approve at the time your policy begins—which means that no matter how much time passes, you’ll receive the agreed-upon amount if you have a total loss.

ORIGINAL PARTS REPLACEMENT

Means original equipment manufacturer (OEM) parts will be available for repairs instead of cheap knock-offs

RENTAL REIMBURSEMENT

Pays up to $10,000 with no daily limit if your insured vehicle is being repaired due to a covered loss.

NEW CAR REPLACEMENT OPTION

Provides the newest model year of your same vehicle if your older-year model is totalled.What Does High-Value Auto Insurance Cover?

Enjoy time on the road knowing you are properly covered.For example, for your spouse’s birthday, you bought them a brand new $105,000 Mercedes-Benz. You selected the Agreed Value Option the day you signed the insurance application, establishing the agreed value at $105,000. Three years later, that vehicle is now valued at $92,000, and you experience a total loss. Per your policy, you would receive $105,000 from your insurer, as agreed upon. No arguing, no negotiating. The contract set the price, not a claims adjuster.

New Car Replacement Option: New car replacement insurance will pay you the amount needed for you to purchase a brand new car of the same make and model instead of the depreciated value of your totaled car.

For example, let’s say you purchased a brand new 2020 Range Rover Autobiography for $131,000. Twelve months later, that vehicle was totaled in an accident. At that time, the 2021 Range Rover Autobiography was selling for $137,000. With the new car replacement option, you would be reimbursed for a new model of the Autobiography, not just $131,000. You aren’t trapped paying the difference.

Rental Reimbursement: All rental reimbursement benefits are not the same.Mass market insurers routinely offer a 30/30 policy, which allows you a maximum benefit of $30 per day, not to exceed 30 days. If you are used to driving a Mercedes-Benz, for example, you would want the same or equivalent type of rental vehicle. It’s highly doubtful that you’ll find a high-value vehicle available at $30 per day..

Not so with a high-value automobile policy. Superior rental reimbursement benefits have no daily limit and a maximum benefit of up to $10,000. As a result, you would be able to rent a vehicle comparable to yours and ride in the same luxury you’re accustomed to

For example, for your spouse’s birthday, you bought them a brand new $105,000 Mercedes-Benz. You selected the Agreed Value Option the day you signed the insurance application, establishing the agreed value at $105,000. Three years later, that vehicle is now valued at $92,000, and you experience a total loss. Per your policy, you would receive $105,000 from your insurer, as agreed upon. No arguing, no negotiating. The contract set the price, not a claims adjuster.

New Car Replacement Option: New car replacement insurance will pay you the amount needed for you to purchase a brand new car of the same make and model instead of the depreciated value of your totaled car.

For example, let’s say you purchased a brand new 2020 Range Rover Autobiography for $131,000. Twelve months later, that vehicle was totaled in an accident. At that time, the 2021 Range Rover Autobiography was selling for $137,000. With the new car replacement option, you would be reimbursed for a new model of the Autobiography, not just $131,000. You aren’t trapped paying the difference.

Rental Reimbursement: All rental reimbursement benefits are not the same.Mass market insurers routinely offer a 30/30 policy, which allows you a maximum benefit of $30 per day, not to exceed 30 days. If you are used to driving a Mercedes-Benz, for example, you would want the same or equivalent type of rental vehicle. It’s highly doubtful that you’ll find a high-value vehicle available at $30 per day.

Not so with a high-value automobile policy. Superior rental reimbursement benefits have no daily limit and a maximum benefit of up to $10,000. As a result, you would be able to rent a vehicle comparable to yours and ride in the same luxury you’re accustomed to.

How to get Started

A plan tailored

to your needs.

After taking time to understand your coverage needs, a personal risk manager will prepare a custom plan designed to protect what's important to you. We take a holistic approach to risk management that looks at your entire portfolio of risks to ensure you are properly covered. No detail is overlooked.