High Value Home & Estate Coverage

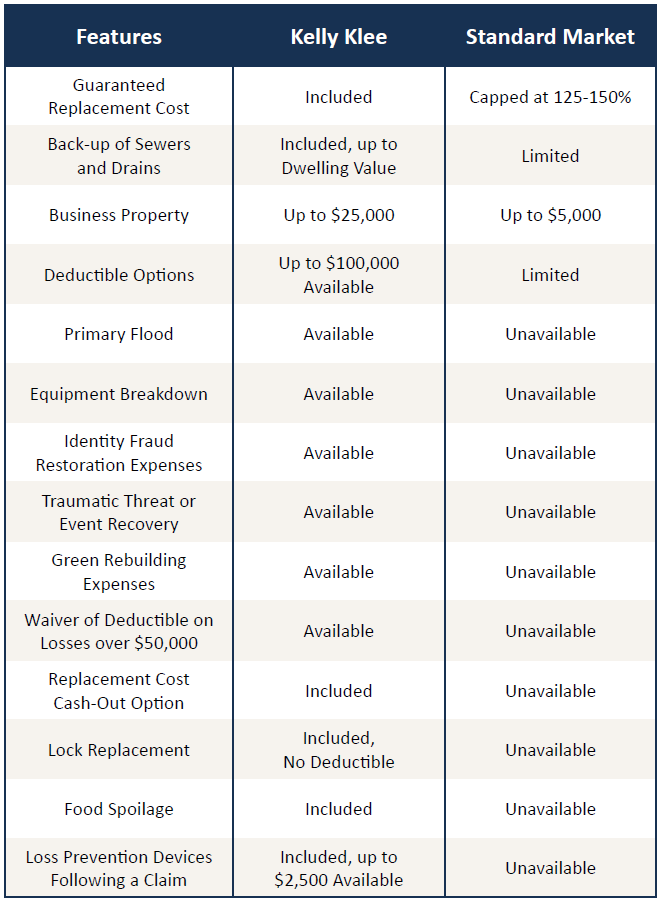

Many insurers will look to limit the amount they pay out in a claim and want to keep the premium low, so they offer inadequate coverage for most high-value homes. Even when the home has proper coverage, there are many other aspects that most mass-market companies don’t offer and should be considered when insuring your high value home.

Personalized service and extra care are trademarks of high-value insurance companies and brokers. Often a high-value insurance provider will not only cover the loss financially, but will go above and beyond to ensure your home repairs meet your satisfaction. For example, they may help you locate a hard-to-find building material or hire an artisan to recreate a detail of your home that was damaged.

A Special Class of Coverage

FULL REPLACEMENT COST

Rebuilds your home and other structures at the existing property after a total loss, even if the cost exceeds the policy limit.

UNLIMITED LOSS OF USE

Covers any additional living expenses while your home is being repaired.

DEDUCTIBLE WAIVER

Waives your deductible (if it is $50,000 or less) on losses over $50,000.

FLEXIBLE LIMITS

Allows you to tailor coverage limits for personal property and other structures by increasing or decreasing them as your circumstances change.What Does High-Value Home Insurance Cover?

Get your life back and rebuild without hassles, headaches, or delays.Suffering a loss as a homeowner can upend your life, and high-value home insurance is designed to reduce your stress and get your life back to “normal” quickly and efficiently as possible. Here are a couple of differentiators that exemplify how high-value homes provide more coverage than a standard policy.

Replacement cost for your personal property: Replacement cost coverage, which high-value home policies generally include automatically, reimburses you for new items to replace the damaged ones – such as new living room furniture. Standard policies will generally offer “actual cash value replacement,” which would give you only the depreciated value of your furnishings, likely leaving you far short when you want to buy new items.

Loss of use: Also known as “additional living expenses (ALE),” loss of use coverage reimburses you for extra expenses that you incur if you can’t live in your home due to a covered loss. For example, it pays for a hotel or temporary relocation and other living expenses if you cannot live in your home because of a covered loss.

The maximum benefit for loss of use with a standard policy is limited. For example, if you insure your home for $1 million, your benefit maximum may be 20% of the home’s value, which may not be enough if it takes a couple of years to be rebuilt or repaired. In contrast with most high-value home policies, there are no limits for your additional living expenses incurred.

How to get Started

A plan tailored

to your needs.

After taking time to understand your coverage needs, a personal risk manager will prepare a custom plan designed to protect what's important to you. We take a holistic approach to risk management that looks at your entire portfolio of risks to ensure you are properly covered. No detail is overlooked.